Purchasing Timeline & Process

What is the "NAR Settlement"

The National Association of Realtors® (NAR) settled a class-action antitrust lawsuit in March 2024, Burnett v. National Association of Realtors® et al., that was filed in 2019 by Missouri home sellers. The plaintiffs alleged that the NAR and large brokerages conspired to inflate commissions paid by sellers, and that the NAR's Code of Ethics and MLS Handbook contributed to inflated commission rates. The plaintiff’s argument centered the mandatory offer of compensation (OC) rule imposed by the National Association of Realtors®. The plaintiffs won their case in late 2023 and were awarded about $1.8 billion, but the NAR settled for $418 million in March 2024. The settlement makes a few additional changes. First, Realtors® can no longer advertise how much commission the seller is offering in the MLS. Second, all buyers are required to enter into a written agreement with a Realtor® before showing homes.

How does the NAR Settlement affect you, the buyer.

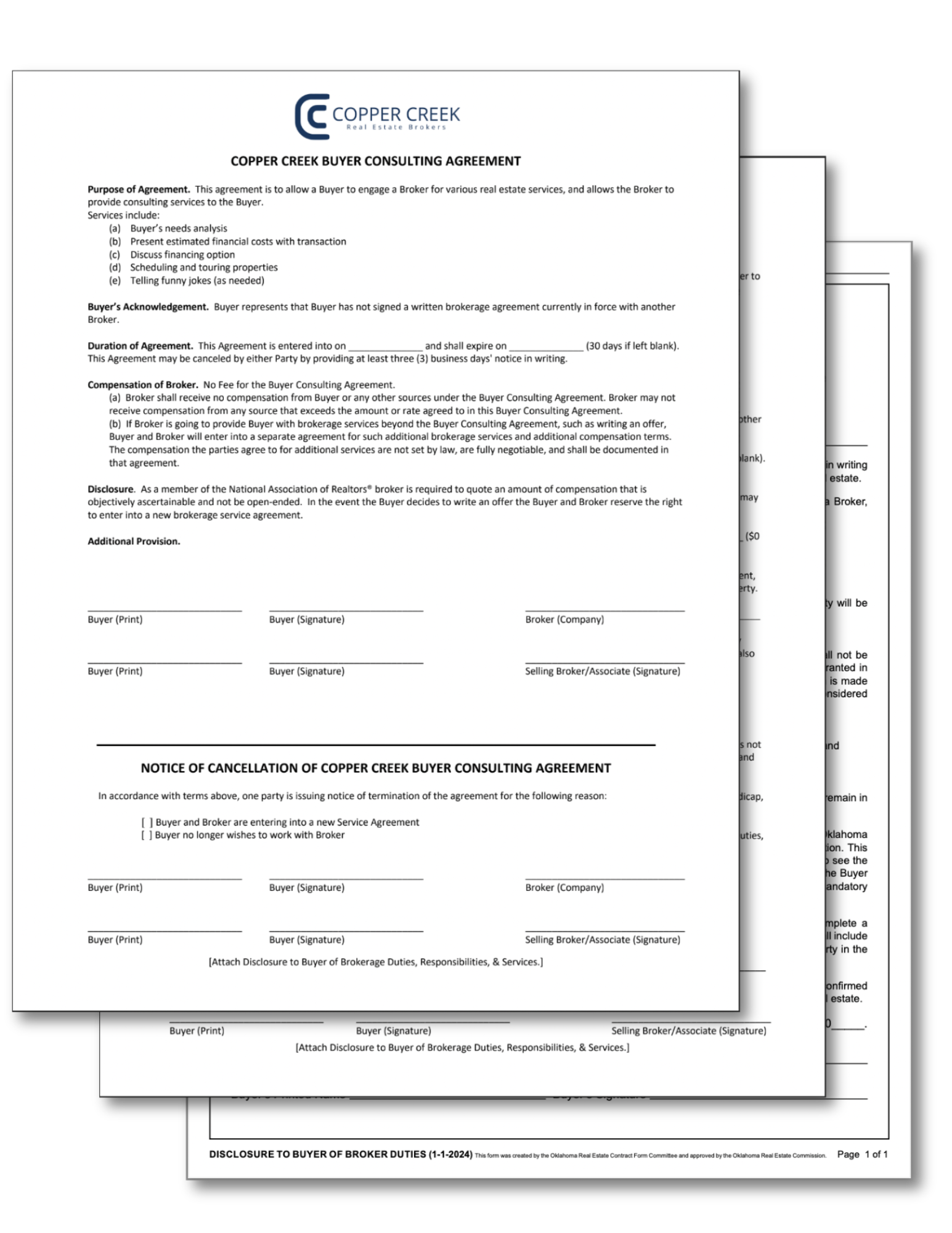

It’s important to remember that realtor commissions have always been negotiable, but after this settlement there will be much more transparency in the way realtors are paid and who is paying them. The primary way this affects you is that you will be required to enter into a written agreement with any realtor that shows you available homes for sale. These agreements will vary greatly from realtor to realtor, but they will all have the same mandatory clauses. They will outline the duration of the agreement, the compensation that the buyer is obligated to pay the realtor. At Copper Creek we understand that buyer’s already have enough expenses when buying a home so we will first attempt to negotiate our compensation to be covered by the seller at closing, reducing the out of pocket expense for you.

Understanding The New Required Documents

All buyer working with Realtors® are required to sign a Written Agreement before showing houses.

Review & understand what you're signing.